TOULOUSE— Airbus has successfully delivered around 300 aircraft by mid-2025, surpassing Boeing, which has reported approximately 278 units. This delivery achievement highlights Airbus’ consistent output from its facilities in Toulouse and Hamburg, despite ongoing engine supply issues.

On the other hand, Boeing’s delivery rate is improving gradually, yet the company continues to face challenges due to regulatory oversight, quality control problems, and a series of notable safety incidents, including a devastating crash involving Air India (AI) earlier this year.

As of June 2025, the competition in global aircraft manufacturing remains intense, with Airbus currently holding the advantage.

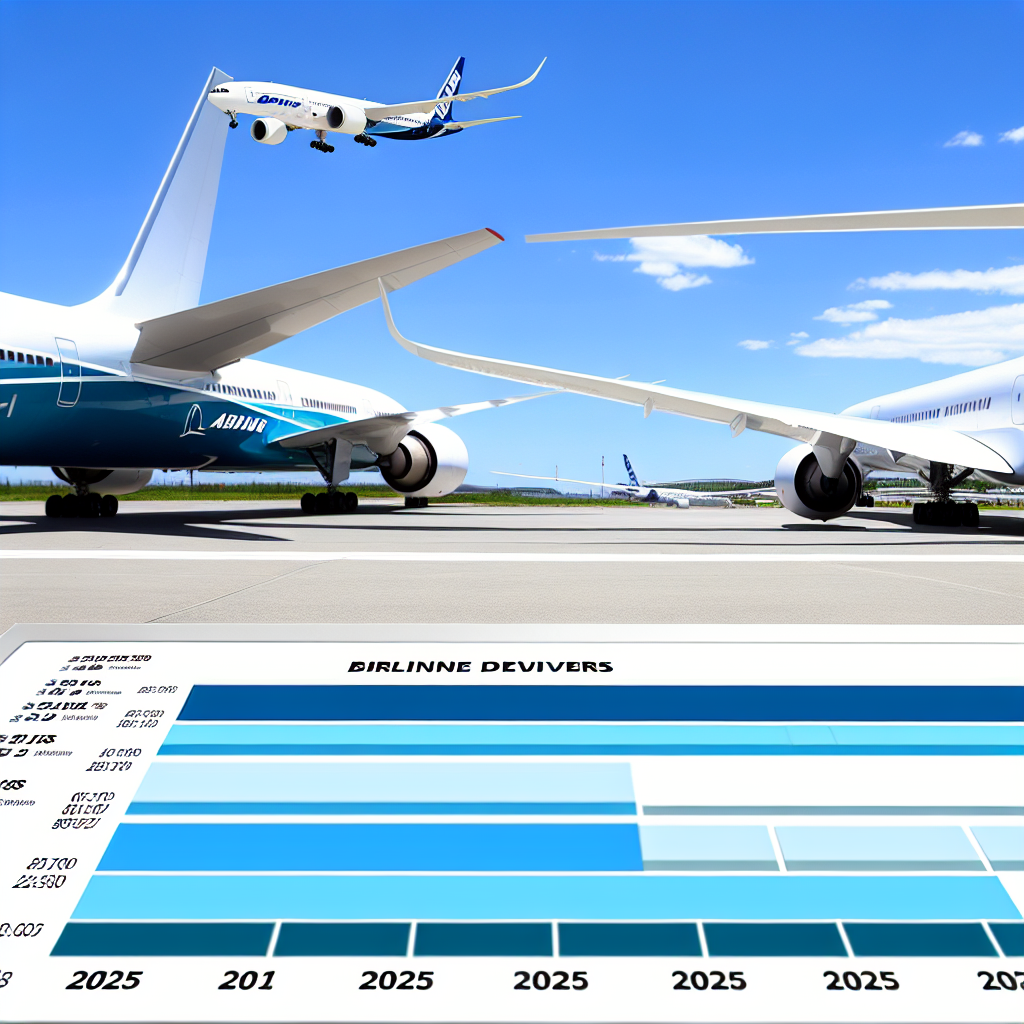

Data from Forecast International indicates that Airbus had delivered around 300 aircraft by the end of June, which includes 243 officially acknowledged deliveries through May and 57 in June.

Boeing closely follows, delivering approximately 278 aircraft, which includes 220 deliveries through May and an estimated 58 in June, slightly surpassing Airbus for that month.

However, this slight lead in a single month was insufficient to significantly reduce the cumulative gap created by Airbus’ consistent performance earlier in the year. Airbus sustained its delivery momentum largely through its A320neo family, A350s, and A220s, delivering 34, 8, and 11 units of each respectively in June.

Improvement in Boeing’s June deliveries primarily stemmed from 737 MAX and 787 Dreamliner models, but persistent challenges with FAA oversight, manufacturing inconsistencies, and door plug inspections kept total output below that of Airbus.

Boeing Q2 2025 Deliveries Surge

Boeing achieved the delivery of 150 commercial aircraft in Q2 2025, representing a 15% increase from Q1 and the company’s best performance in the second quarter since 2018. This includes a resurgence in deliveries to China alongside robust output of the Boeing 737 MAX.

Deliveries to Chinese airlines resumed in June with aircraft designated for Xiamen Airlines, China Southern, Air China, and Minsheng Financial Leasing. Most deliveries were processed from Seattle (SEA), Boeing’s primary delivery hub.

In total, Boeing delivered 280 units in the first half of 2025, supported by increased production across all of its widebody and narrowbody programs. Between April and June, deliveries included 104 737s, 24 787s, 13 777s, and 9 767s, with 60 aircraft delivered in June—marking the company’s highest monthly total since December 2023.

The 787 Dreamliner program nearly doubled production from Q1 to Q2, with 24 units delivered compared to 13 in the first quarter.

This increase followed improved relations between the U.S. and China, allowing eight aircraft—mostly 737 MAXs—to be delivered to Chinese carriers. Juneyao Air (HO) received a deferred 787-9, with Air China Cargo (CA) taking delivery of a 777 Freighter.

Quarterly Comparison and Order Highlights

Boeing’s output in Q2 signifies a 15% rise from the 130 aircraft delivered in Q1. Notably, widebody deliveries alone nearly doubled:

| Aircraft | Q1 | Q2 | YTD |

|---|---|---|---|

| 737 | 105 | 104 | 209 |

| 767 | 5 | 9 | 14 |

| 777 | 7 | 13 | 20 |

| 787 | 13 | 24 | 37 |

| Total | 130 | 150 | 280 |

As part of its successful deliveries, Boeing secured 427 aircraft orders in Q2, a dramatic increase from the mere 25 orders received in Q2 2024. Notably, in May, the company registered 303 gross orders—its highest monthly total since 2023.

A standout order originated from Qatar Airways (QR), which placed a historic request for 160 aircraft—comprising 130 Boeing 787 Dreamliners and 30 777-9s, with options for an additional 50 aircraft.

737 MAX Production at Full Capacity

Boeing maintains a production pace of 38 aircraft per month for the 737 MAX, a ceiling established after the January 2024 door plug incident involving Alaska Airlines (AS). The company has invested significantly in bolstering quality controls and safety measures.

According to its most recent Chief Aerospace Safety report, Boeing has noted improvements across all safety and quality benchmarks.

CEO Kelly Ortberg expresses optimism that production could eventually rise to 42 jets per month, contingent on FAA approval. Company executives have stressed a commitment to high production quality while meeting global delivery targets.

Regulatory Pressure Weigh on Boeing’s Performance

Production delays at Boeing for 2025 extend beyond supply chain constraints. The company’s safety record has been scrutinized intensely following multiple incidents.

The most severe of these was the tragic incident involving Air India Flight AI171, operated by a Boeing 787-8, which resulted in 241 fatalities. This devastating event raised significant concerns regarding the safety of the 787 model.

Moreover, a United Airlines (UA) 787 faced a violent pitch-down due to a malfunctioning pilot seat mechanism earlier this year, further damaging public trust.

Additional reports of cabin smoke on selected 737 MAX models, as reported by Bloomberg, have contributed to Boeing’s safety challenges, overshadowing recent improvements in delivery figures.

In light of these issues, Boeing has implemented leadership changes and is collaborating with the Federal Aviation Administration (FAA) to enhance inspection protocols and rebuild operational reliability. However, restoring its reputation remains a tougher challenge than logistical recovery.

Airbus Builds Momentum with Operational Stability

In contrast, Airbus has shown remarkable resilience, operating successfully from its Toulouse (TLS) and Hamburg (XFW) assembly facilities amidst similar obstacles.

Despite significant engine shortages—notably with Pratt & Whitney PW1000G engines—temporarily sidelining numerous jets, including 40 from Wizz Air (W6), Airbus has managed to achieve an average monthly output of approximately 50 jets.

The manufacturer capitalizes on its global supply chain and cross-program efficiencies to ensure stable deliveries throughout various product lines. The approach focuses on gradual ramp-ups in production while minimizing dependence on any single supplier or program.

Operational contributions from the A220 and A350 programs, although smaller compared to the A320neo, have also played an essential role in boosting Airbus’ overall delivery numbers.

Stay updated with us. Additionally, connect with us on social media to get the latest news.

Join us on Telegram Group for the latest aviation updates. Also, follow us on Google News

Based on an article from aviationa2z.com: https://aviationa2z.com/index.php/2025/07/09/boeing-beats-airbus-in-june-2025-deliveries/?utm_source=rss&utm_medium=rss&utm_campaign=boeing-beats-airbus-in-june-2025-deliveries